Private Equity

SME

4 minutes

20/05/2024

Foresight invests £4.5 million into electronics manufacturing innovator ACL

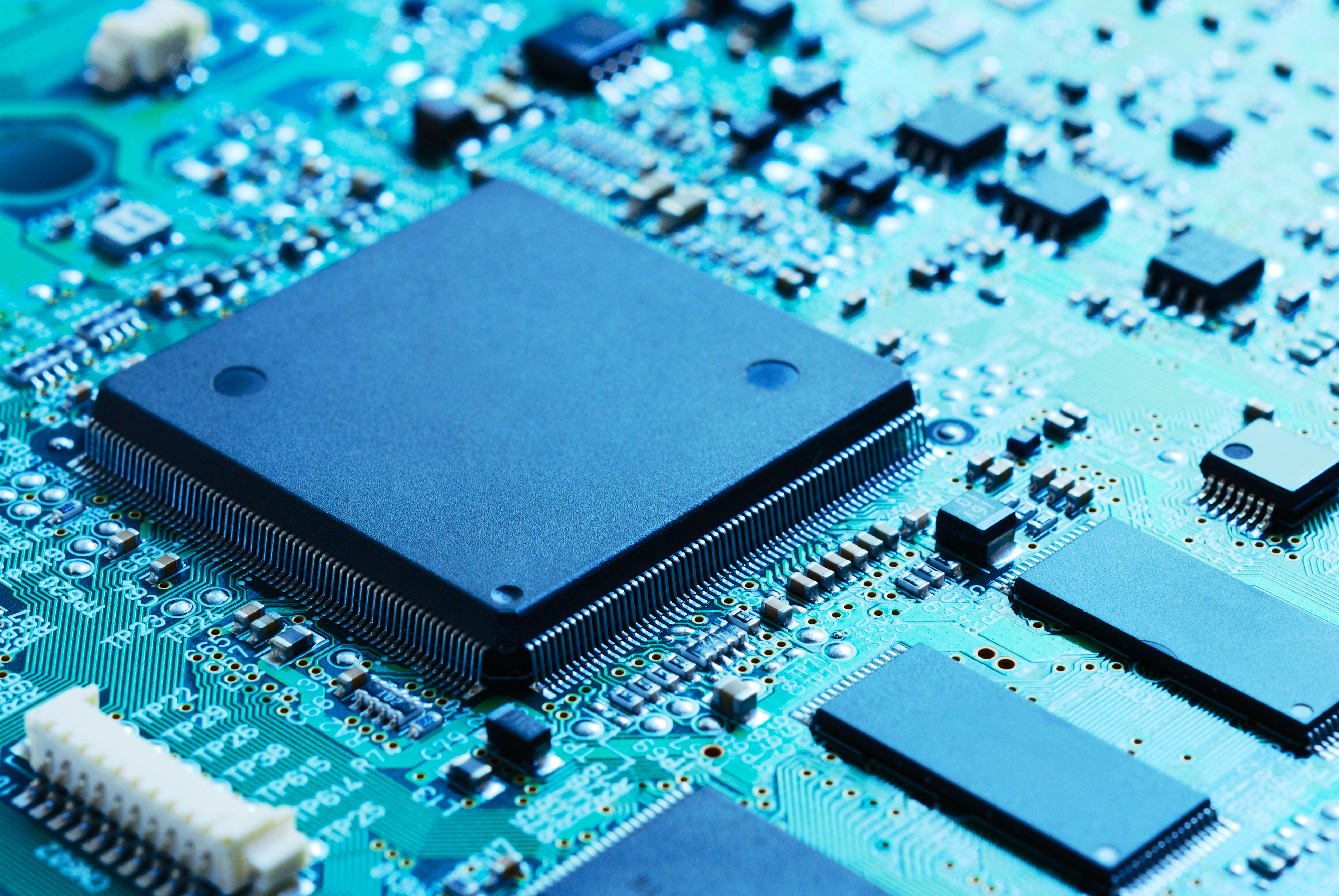

Foresight Group has announced a £4.5 million investment into Assembly Contracts Limited, a leading manufacturer of printed circuit board assembly (PCBAs) for use in electronic devices and applications.

- Manchester firm manufactures printed circuit board assemblies, sub-assemblies and complete electronic products and applications

- Investment reflects Foresight Group’s commitment to supporting innovative manufacturers across the UK

- ACL set to consolidate position as first port of call for customers across multiple vertical markets

Click here to download the PDF version.

Manchester, 20 May 2024: Foresight Group (“Foresight”), a leading regional private equity and infrastructure investment manager, has announced a £4.5 million investment into Assembly Contracts Limited (“ACL” or the “Company”), a leading manufacturer of printed circuit board assembly (PCBAs) for use in electronic devices and applications.

The Company, based in Wythenshawe, south Manchester where it employs 37 people, was founded by Adrian Jones in 1989. ACL manufactures bespoke product runs for customers in multiple vertical markets.

It holds many industrial approvals and has a diverse client base amongst a wide variety of sectors in the UK and internationally. The Company has a strong presence in transport and counts a number of major car manufacturers as customers. It also operates in the green technology sector working with power generation suppliers – and helps support life science innovators to bring new medical devices to market.

Foresight’s investment will allow ACL to scale up its operations, creating new skilled jobs. ACL has also benefitted from customers increasingly near-shoring their manufacturing process, resulting in surety of supply chain, a trend which is set to continue.

The investment from Foresight’s fund dedicated to the North West will see the appointment of Richard Webster as Executive Chair. Richard has extensive experience as a CEO and MD in privately owned, public and private equity owned businesses, helping to improve financial and operational performance. Tim McInnes – an experienced portfolio Finance Director having worked with several private equity backed businesses - joins as Finance Director.

Both Tim and Richard will support Adrian’s long-term succession planning as well as the wider expansion of the current team, which is based at a purpose-built 15,000sq ft premises on the Roundthorn Industrial Estate.

Adrian Jones, Founder and CEO of ACL, said: “As an ambitious Manchester-based contract electronic manufacturer, this is a great milestone for ACL and we are delighted to have secured investment from Foresight. We look forward to working with Foresight, Richard Webster and Tim McInnes as we continue our mission to support organisations in producing high quality products.“

Fiona Hatch, Senior Investment Manager at Foresight Group in Manchester, said: “ACL is already renowned as an expert manufacturer that serves a range of different sectors – as such, it has huge potential and we are looking forward to supporting the team in their next phase of growth, ensuring more companies and industries benefit from ACL’s expertise and quality commitment.”

ENDS

Advisers to the Company: (if appropriate)

Corporate Finance: Cleveland Scott

Legal Advice: Eversheds Sutherland

Advisers to Foresight:

Financial DD: Cortus Advisory

Legal Advice: Aaron and Partners

Management DD: Catalysis Advisory

Technical DD: CloudOrigin

Insurance DD: Lockton Companies

Commercial DD: RP Advisory

Notes to Editors

For more information contact:

Lucy Sherwood: marketing@foresightgroup.eu / +44 (0)20 3667 8100

Tom Carlin: carlin@thisisinfluential.com / +44 7827957740

About Foresight Group Holdings Limited

Foresight Group was founded in 1984 and is a leading listed infrastructure and private equity investment manager. With a long-established focus on ESG and sustainability-led strategies, it aims to provide attractive returns to its institutional and private investors from hard-to-access private markets. Foresight manages over 400 infrastructure assets with a focus on solar and onshore wind assets, bioenergy and waste, as well as renewable energy enabling projects, energy efficiency management solutions, social and core infrastructure projects and sustainable forestry assets. Its private equity team manages eleven regionally focused investment funds across the UK and an SME impact fund supporting Irish SMEs. This team reviews over 3,000 business plans each year and currently supports more than 250 investments in SMEs. Foresight Capital Management manages four strategies across seven investment vehicles.

Foresight operates in eight countries across Europe, Australia and United States with AUM of £11.9 billion*. Foresight Group Holdings Limited listed on the Main Market of the London Stock Exchange in February 2021 and is a constituent of the FTSE 250 index. https://www.foresightgroup.eu/shareholders

*Based on unaudited AUM as at 31 March 2024.