Private Equity

SME

4 minutes

29/09/2022

Foresight completes a multi-million pound investment into Quanta, a North East specialist engineering service provider

Foresight has made a multi-million pound investment to support the growth of Quanta EPC Holdings Limited.

- Second investment from the Foresight North East Fund

- Quanta will play a key part in the drive for UK energy security and the decarbonisation of energy supply

- Investment from the new Foresight North East Fund, cornerstone funded by Durham County Council’s Pension Fund and funding from Teesside Pension Fund

Click here to read the PDF version.

NEWCASTLE, 27 September 2022: Foresight Group (“Foresight”), a leading listed infrastructure and regional private equity investment manager, has made a multi-million pound investment to support the growth of Quanta EPC Holdings Limited (“Quanta” or the “Company”).

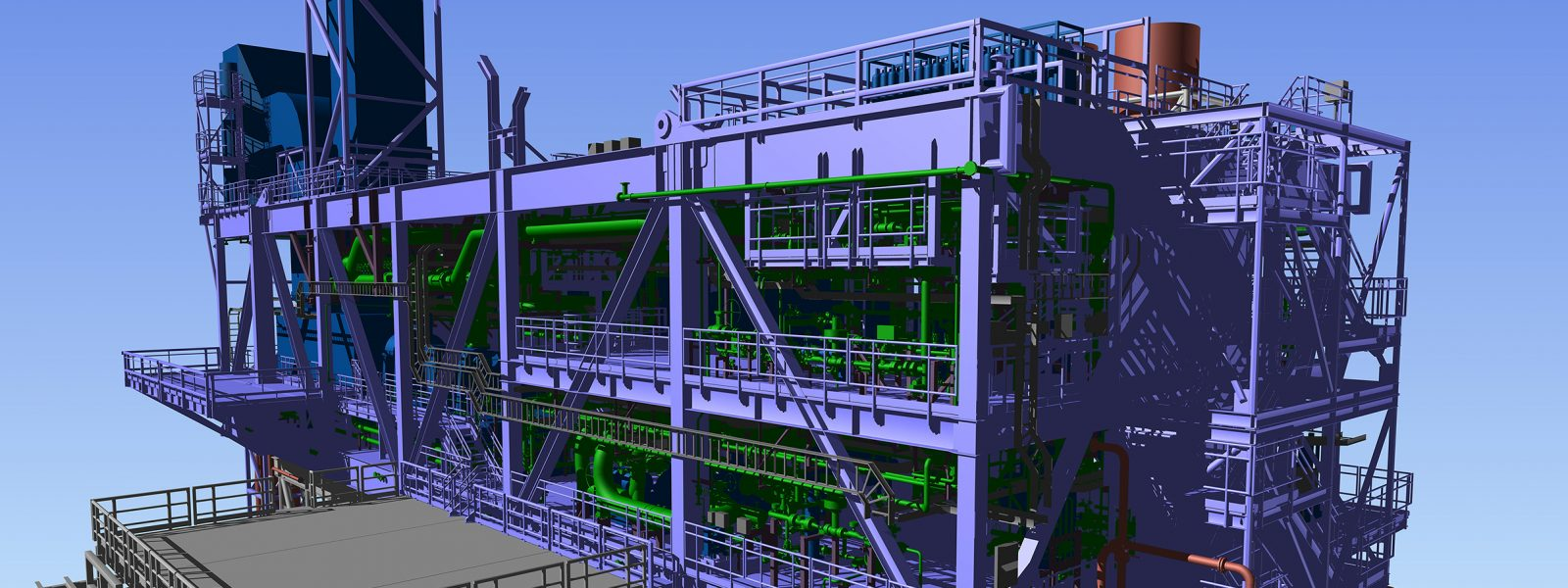

Based in the North East, Quanta is a specialist provider of engineering and consultancy services to the energy sector, focused on improving UK energy security and supporting the energy transition from fossil fuels to renewable energy.

Since leading a buyout from Engie Group in 2018, CEO Nick Oates has broadened the Company’s services into renewables and other infrastructure. Quanta’s experience and skillsets are applicable in the growing markets of hydrogen, carbon capture and offshore wind and Foresight’s investment will help accelerate the Company’s presence in these markets. Quanta is also ideally placed to support the increased focus on UK energy independence, underpinned by the Government’s British Energy Security Strategy.

Foresight’s commitment to the Company comprises a multi-million pound investment from the Foresight North East Fund, which was launched with ‘cornerstone’ funding from Durham County Council’s Pension Fund and additional funding from Teesside Pension Fund. The investment will enable the Company to grow its North East staff base, creating high quality jobs in the region, as well as expand operations. Foresight has supported its investment with the appointment of local industry specialist Ian Clifford, who will join the board as non-executive Chairperson, and Catherine Earl, an experienced Finance Director.

Nick Oates, Chief Executive Officer at Quanta, said: “We are delighted to be working with Foresight and are excited about the future. Our ability to capitalise on future growth opportunities and support our clients is now enhanced by an experienced, local investment partner. As we look forward, we are assisting our clients to tackle various energy challenges, including the need for increased domestic energy security in line with the Government’s British Energy Security Strategy, whilst also driving the Energy Transition – with Foresight’s backing we are looking to the future with ambition and high expectations.”

Jordan Lavender, Investment Manager at Foresight, added: “Quanta has built a strong reputation within the energy sector as a specialist engineering service provider. We look forward to partnering with Quanta’s management team to drive the business forward, accelerate growth and secure upcoming opportunities.”

Cllr Richard Bell, Durham County Council’s Cabinet member for finance, said: “This investment is an example of how we are supporting the growth of independent businesses through our contribution to the North East Fund. We are delighted that Quanta has been able to benefit from this investment and look forward to seeing more businesses achieve the same level of growth through the Fund.”

END

Contacts

Chris Barry, Influential: Barry@thisisinfluential.com / +44 (0)7733 103 693

Lucy Sherwood, Foresight Group: marketing@foresightgroup.eu / +44 (0)7774 432 466

Advisors

- Legal – Muckle

- Financial and tax DD – Haines Watts

- Commercial – Calash

- Insurance – Vista

- Cyber – Kryptokloud

- Management – Catalysis

Management advisors

- Corporate Finance – UNW

- Legal – Sintons

- Tax – Azets

About Foresight Group

Foresight Group was founded in 1984 and is a leading listed infrastructure and private equity investment manager. With a long-established focus on ESG and sustainability-led strategies, it aims to provide attractive returns to its institutional and private investors from hard-to-access private markets. Foresight manages over 330 infrastructure assets with a focus on solar and onshore wind assets, bioenergy and waste, as well as renewable energy enabling projects, energy efficiency management solutions, social and core infrastructure projects and sustainable forestry assets. Its private equity team manages ten regionally focused investment funds across the UK and an SME impact fund supporting Irish SMEs. This team reviews over 2,500 business plans each year and currently supports more than 200 investments in SMEs. Foresight Capital Management manages four strategies across six investment vehicles with an AUM of over £1.6 billion.

Foresight operates from 13 offices across seven countries in Europe and Australia with AUM of £12.4 billion*. Foresight Group Holdings Limited listed on the Main Market of the London Stock Exchange in February 2021. https://www.fsg-investors.com/

*Based on Foresight Group unaudited AUM as at 30 June 2022 and Infrastructure Capital's unaudited AUM as at 30 June 2022 converted from AUD to GBP at an exchange rate of 0.5846 as at 7 September 2022.