Private Equity

4 minutes

31/07/2020

Business Matters: How to get investment in turbulent times?

It’s a question often asked by companies, especially in the aftermath of a financial ‘shock’ like the meltdown in 2008 and the current COVID-19 pandemic.

How to get investment in turbulent times?

It’s a question often asked by companies, especially in the aftermath of a financial ‘shock’ like the meltdown in 2008 and the current COVID-19 pandemic. A lot of funders, both debt and equity providers, tend to pull up the proverbial drawbridge to take stock of the situation and receive guidance from their boards on what their appetite is for funding deals in the new world. If you’re a company looking for equity investment you may find offers of funding mysteriously evaporate or that your former plans to go to the market in late 2020 are now in tatters. What then? Is it worth even trying to get equity now? What could you possibly say that will look attractive to equity investors?

The good news is that whilst the financial world is genuinely in turmoil, uncertainty does not necessarily put off all equity investors. In fact, history has told us time and again that those equity providers who are prepared to be brave and back their judgement, quite often come out the other side having a classic ‘vintage’ in their portfolio.

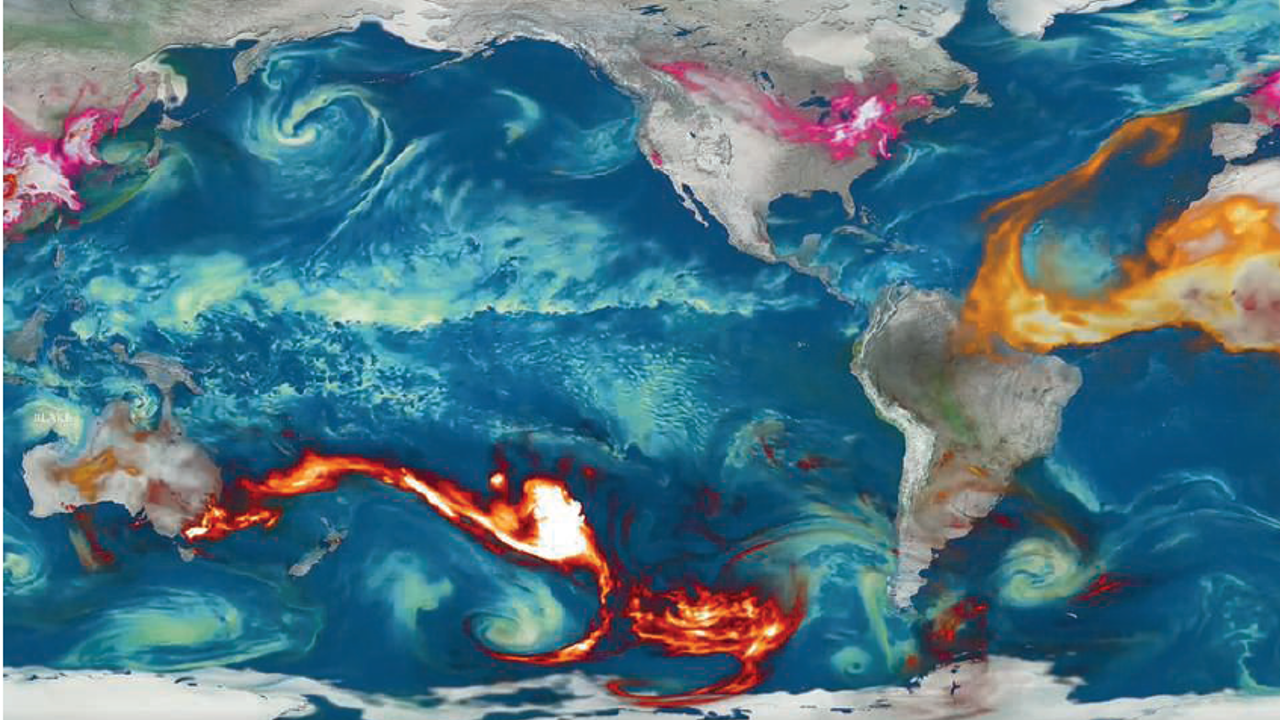

All at sea?

What does a company need then to secure investment in such troubled times? Perhaps a sailing analogy can help.

First, you need to have a business that i) can navigate the COVID-19 riptide ii) is robust enough to ride out the financial waves, or iii) is maneuverable enough to change its model and plot a new course.

In some respects, the course you’re on when the headwinds hit is interesting but not that vital. In order to survive the storm, you may need to reef in the sail, lighten the load, batten down the hatches and modify your course to bring the wind behind you. Continuing to plough on, beating into the teeth of the gale is just not a great strategy.

As an equity funder the first question we ask is ‘what does the new post COVID-19 plan look like?’ If the answer is that you haven’t changed course, then you are either very lucky or you must be an oil tanker with vast fuel reserves (cash in this case) to keep you heading in your original direction. If, like most companies, that’s not you, then why not change tack for a while. Adapt your business model to the new normal because we don’t know how long this will last. By doing so you immediately show equity providers that you are nimble enough to make the necessary changes that will inevitably be required to plot the choppy waters ahead. None of us can predict the future, but the ‘wall of equity’ is still out there and would like to find an experienced captain with a nimble ship and crew. Without a reliable map to guide us, the key skill is adaptability and ability to give the rocks a wide berth.

A new realism

Second, you need to be realistic about the valuation of your business in the new world. Towards the end of last year many businesses were successfully able to drive higher and higher valuations against a backdrop of a buoyant funding market. Those tailwinds have now dropped back quite substantially so maybe it’s time to re-assess if your original hopes and aspirations are still valid or are a barrier to the process. Everyone accepts that house prices go up and down and so do business valuations.

As a regionally focused equity provider with specific targeted funds for the Midlands and East of England regions, as well as Scotland and the North West, Foresight has money to invest in those businesses that can demonstrate their adaptability. We also have the appetite to invest between £250,000 and £5 million in the current environment, as demonstrated by the fact that we have recently completed two investments in the Midlands region, including one new deal that started after lockdown struck. A pipeline of four more deals planned over the summer holidays will definitely show the market that Foresight’s course is set fair to the New World. As a business with over thirty-five years of investing experience, we’ve seen enough storms and turbulent waters to have navigated our present fleet of over 100 portfolio companies safe passage with a combination of financial support and experience.

Whilst you lie on the sun lounger on the deck in your back garden this summer contemplating your next move, you might want to think about roping us in. We’d be pleased to get on board.

Ray Harris, Principal for the Midlands Engine Investment Fund (MEIF)

First published in Insider Media 29/07/2020